Financial turndown traffic refers to customers who are rejected for loans or financial services due to various reasons. These rejections could be due to a low credit score, a high debt-to-income ratio, or other red flags that financial institutions deem risky. This traffic is a lost opportunity for businesses, as they are unable to provide services to these potential customers. However, there exists a solution that not only aids these customers but also provides a revenue stream for businesses and website owners. This article aims to explore the concept of financial turn down traffic, delve into the affiliate program for credit improvement, and present how businesses can turn a situation of rejection into a win-win scenario.

To understand financial turndowns, let’s start by defining the term. Financial turndown refers to individuals who have been declined for loans or financial services due to their financial standing. This could be due to a low credit score, a history of missed payments, or a high debt-to-income ratio. These factors make the individual a high-risk prospect for lenders, leading to the application being rejected.

The process of applying for a loan or a financial service usually involves a thorough assessment of the applicant’s financial history and current standing. Credit scores, which are a numerical representation of an individual’s creditworthiness, play a significant role in this process. A low credit score can be a result of several factors including late payments, high credit card utilization, or a history of bankruptcy. Each of these elements raises a red flag for lenders, making the applicant a risky proposition.

Similarly, an applicant’s debt-to-income ratio is another critical factor considered during the loan approval process. This ratio, calculated by dividing an individual’s total monthly debt payments by their monthly income, gives lenders an idea of the applicant’s ability to handle the payments associated with the new debt. If this ratio is too high, it indicates that the applicant might struggle to make their loan payments, leading to their loan application being turned down.

When customers are unable to obtain a loan or financial service, it leads to frustration and uncertainty. They might feel stuck, unsure of how to improve their situation. This, in turn, affects their financial plans and goals. On the other hand, businesses that have to turn down customers lose potential revenue. Furthermore, the process of assessing and processing an application involves time and resources. When an application is rejected, these resources are effectively wasted, leading to a financial loss for the business.

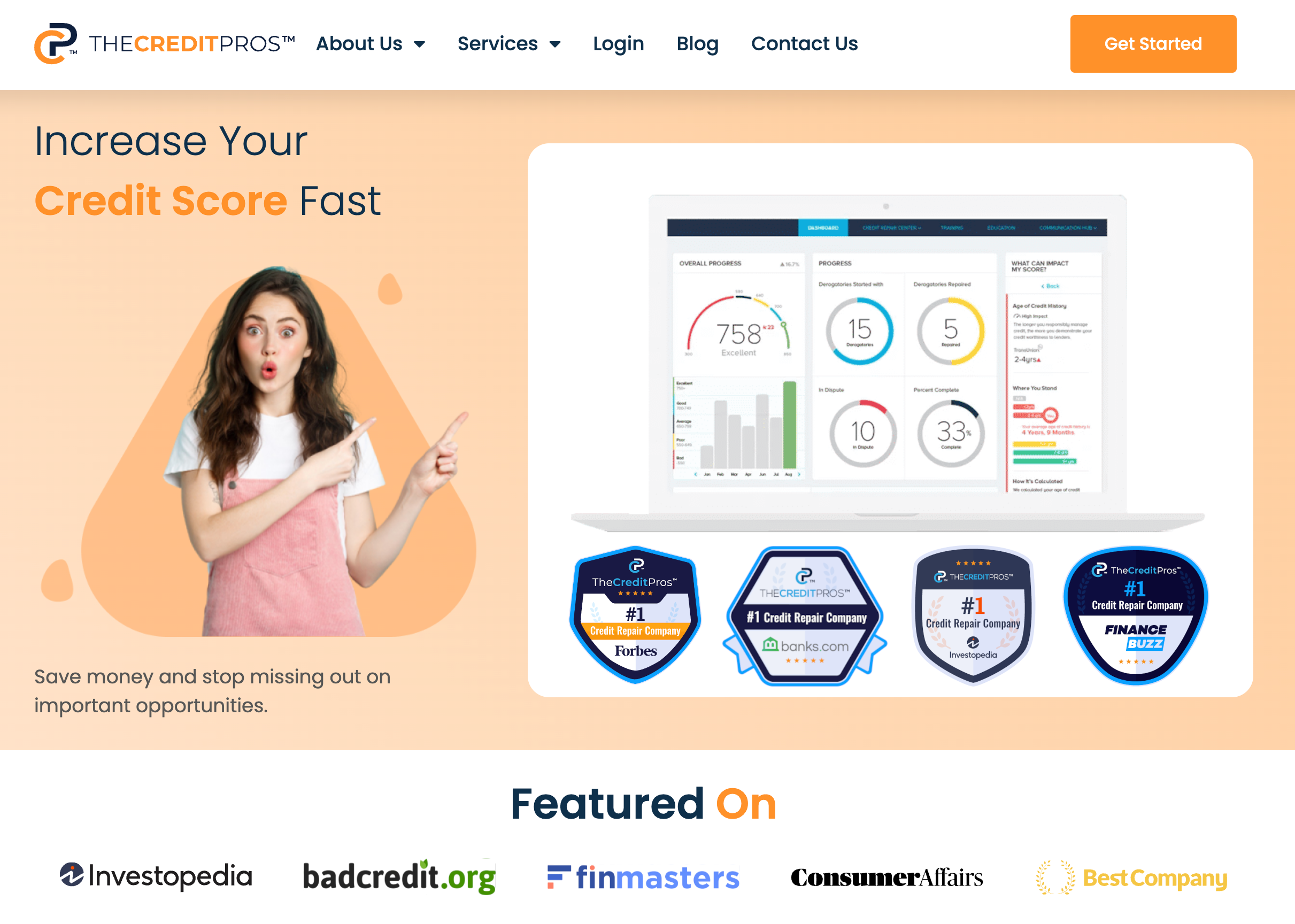

However, there exists a solution that can benefit both parties – The Credit Pros offers an affiliate program for credit repair and credit score improvement. This program involves businesses and website owners referring rejected customers to credit repair services. By doing so, they provide a path for these customers to improve their financial standing, while also earning a commission for their referral. This solution not only addresses the issue of financial turndown traffic but also creates an additional revenue stream for businesses.

In the world of credit and finance, credit repair and improvement services play a crucial role. These services aim to help individuals improve their credit score and overall financial health. They provide expert advice and strategies tailored to the individual’s situation, helping them address the issues that led to their loan application being rejected. These services can help individuals reduce their debt, manage their finances better, and ultimately repair their credit score. This, in turn, increases their chances of their loan application being accepted in the future.

Businesses can benefit from referring customers to these services. For every customer that signs up for the credit repair service through their referral, the business earns a commission. This not only recoups some of the losses incurred due to the application being rejected but also helps maintain a relationship with the customer. By offering a solution to the customer’s problem, businesses position themselves as a helpful and supportive ally, rather than just a service provider. This can lead to the customer returning to the business once their credit score has improved, creating a potential future revenue stream.

A prime example of a credit repair and improvement service is The Credit Pros. Established with a mission to empower individuals to improve their financial health, The Credit Pros offers a range of services designed to help clients understand and improve their credit. Their team of certified credit experts and attorneys work with clients to identify and address issues affecting their credit score, providing personalized strategies to help them achieve their financial goals.

When a business refers a customer to The Credit Pros, there is a dual benefit. The customer gets access to professional services that can help them improve their credit score, and the business earns a commission for the referral. The Credit Pros has a robust affiliate program that provides businesses with an opportunity to monetize their turn down traffic. This program is an example of how businesses can earn from customers they initially couldn’t serve, turning a potential loss into a gain.

Consider a scenario where a customer applies for a loan but is turned down due to a low credit score. The business, instead of simply rejecting the application, refers the customer to The Credit Pros. The customer then signs up for their services, and as a result, the business earns a commission.

Over time, as the customer works with The Credit Pros and improves their credit score, they might reapply for the loan. This time, their application is accepted, and the business gains a new customer. This win-win scenario is made possible due to the affiliate program for credit repair and credit score improvement like Credit Repair Cash.

The approach of referring customers to credit repair and improvement services is not just about recovering lost revenue. It’s about helping customers find a path to improve their financial standing. It’s about showing empathy and understanding towards customers who are facing financial difficulties and offering a solution that can help them overcome these challenges.

Businesses that adopt this approach demonstrate their commitment to their customers’ well-being, which goes a long way in building trust and loyalty. Even if the customer was initially turned down, the fact that the business offered a helpful solution can leave a positive impression. This can significantly enhance the business’s reputation and customer relationships, leading to long-term benefits.

In conclusion, financial turndown traffic is a reality that many businesses face. However, it doesn’t have to be a dead-end. With solutions like affiliate programs for credit improvement, businesses can turn this challenge into an opportunity. They can help their customers improve their financial standing, earn from referrals, and strengthen their customer relationships. By doing so, businesses can turn the rejection of a loan application into a win-win situation, benefiting both the customer and the business. It’s a testament to the fact that even in the face of rejection, there’s always a way forward.